Unlocking the Power of Accelerated Debt Repayment: A Comprehensive Guide to Amortization Calendars with Extra Payments

Related Articles: Unlocking the Power of Accelerated Debt Repayment: A Comprehensive Guide to Amortization Calendars with Extra Payments

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Unlocking the Power of Accelerated Debt Repayment: A Comprehensive Guide to Amortization Calendars with Extra Payments. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Unlocking the Power of Accelerated Debt Repayment: A Comprehensive Guide to Amortization Calendars with Extra Payments

- 2 Introduction

- 3 Unlocking the Power of Accelerated Debt Repayment: A Comprehensive Guide to Amortization Calendars with Extra Payments

- 3.1 Unveiling the Amortization Calendar: A Visual Representation of Debt Repayment

- 3.2 The Power of Extra Payments: A Catalyst for Accelerated Debt Reduction

- 3.3 Understanding the Impact of Extra Payments

- 3.4 Strategies for Incorporating Extra Payments

- 3.5 The Impact of Extra Payments: A Real-World Example

- 3.6 FAQs on Amortization Calendars with Extra Payments

- 3.7 Tips for Maximizing the Benefits of Extra Payments

- 3.8 Conclusion: Empowering Financial Freedom through Accelerated Debt Repayment

- 4 Closure

Unlocking the Power of Accelerated Debt Repayment: A Comprehensive Guide to Amortization Calendars with Extra Payments

In the realm of personal finance, understanding the intricacies of debt repayment is paramount. While traditional amortization schedules provide a roadmap for loan repayment, incorporating extra payments can significantly accelerate the process, leading to substantial savings in interest and a faster path to financial freedom. This guide delves into the concept of amortization calendars with extra payments, exploring their benefits, implementation strategies, and practical applications.

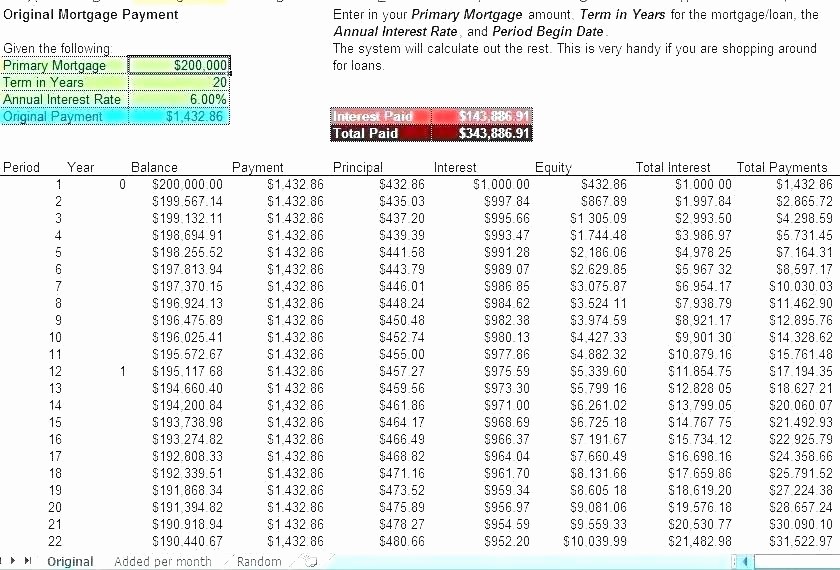

Unveiling the Amortization Calendar: A Visual Representation of Debt Repayment

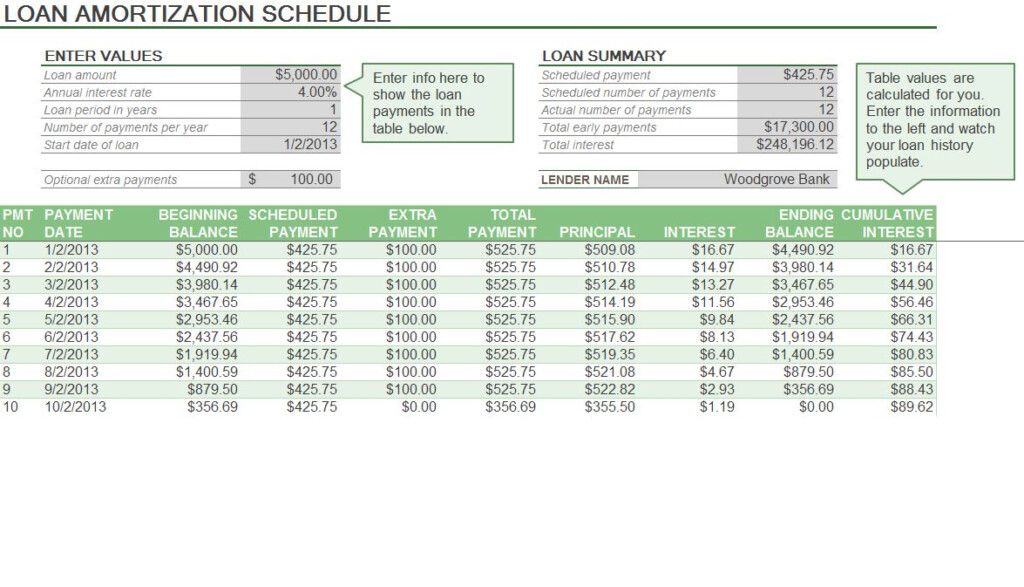

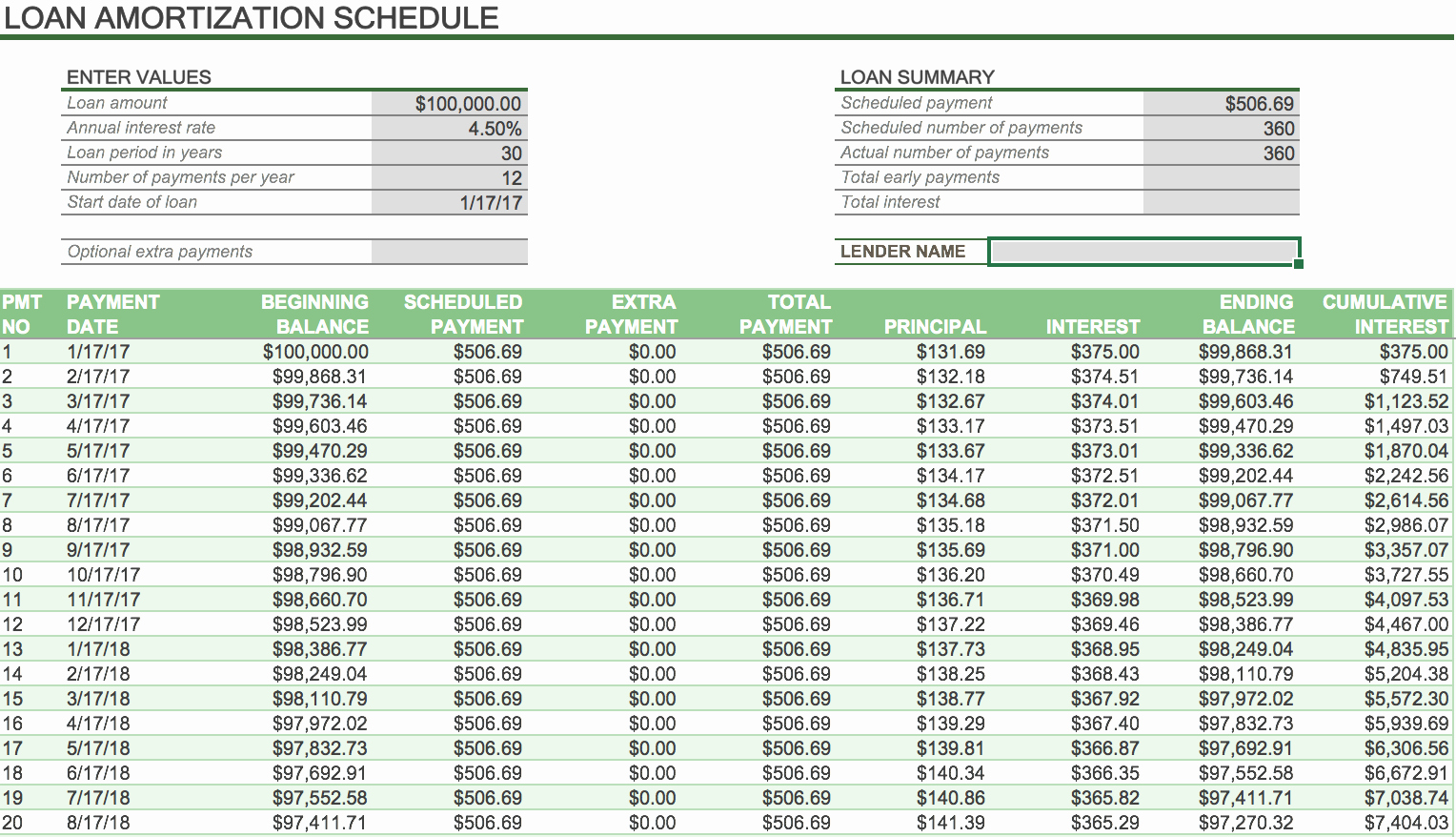

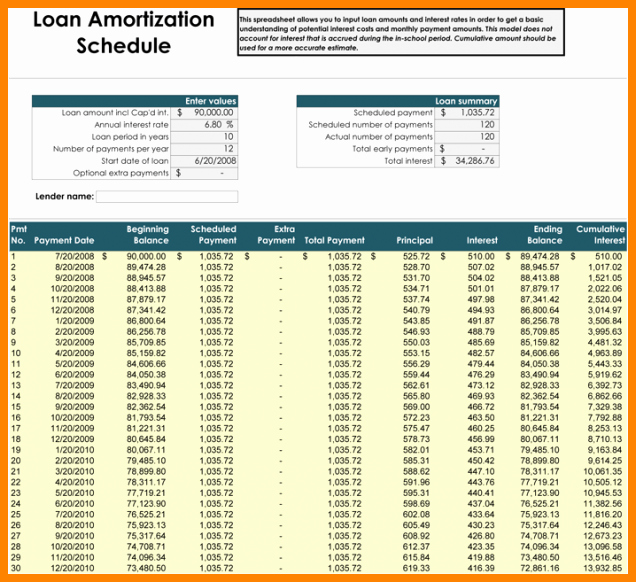

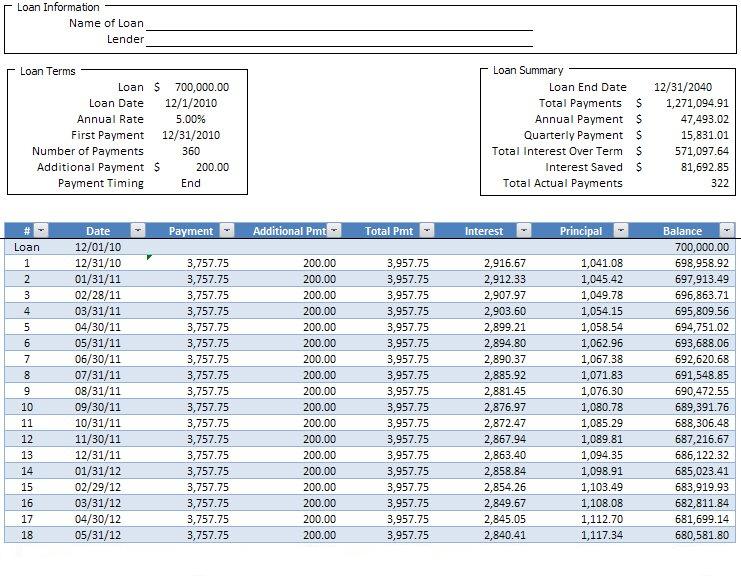

An amortization calendar, essentially a detailed breakdown of loan repayment, acts as a visual guide, outlining the principal and interest components of each payment over the loan’s lifespan. It provides a clear understanding of how your payments are allocated, allowing you to track progress and anticipate future obligations.

Each row in the calendar represents a payment period, typically monthly, while columns display key elements like:

- Payment Number: This column identifies the sequence of payments.

- Payment Amount: This column details the fixed amount due each period.

- Principal Payment: This column indicates the portion of each payment dedicated to reducing the loan’s principal balance.

- Interest Payment: This column reflects the amount of interest accrued on the outstanding principal.

- Outstanding Principal: This column showcases the remaining loan balance after each payment.

The Power of Extra Payments: A Catalyst for Accelerated Debt Reduction

While traditional amortization schedules are based on fixed payments, incorporating extra payments offers a powerful strategy for accelerating debt repayment. These additional funds, applied towards the principal balance, directly reduce the loan’s outstanding amount, leading to a faster payoff and significant interest savings.

Understanding the Impact of Extra Payments

The benefits of extra payments are manifold:

- Reduced Interest Costs: By decreasing the outstanding principal, extra payments minimize the interest accrued over the loan’s term, leading to substantial financial savings.

- Faster Debt Elimination: Extra payments accelerate the repayment process, enabling you to reach debt-free status sooner, freeing up cash flow for other financial goals.

- Increased Financial Flexibility: As you pay off debt faster, you gain greater control over your finances, allowing for more strategic budgeting and allocation of resources.

- Improved Credit Score: A reduced debt burden can positively impact your credit score, opening doors to better interest rates and financial opportunities.

Strategies for Incorporating Extra Payments

Several strategies can be employed to effectively integrate extra payments into your repayment plan:

- Regular Lump-Sum Payments: Allocate a fixed amount, such as a bonus or tax refund, towards the principal balance at regular intervals.

- Automatic Transfers: Set up automatic transfers from your checking account to your loan account, ensuring consistent extra payments without manual intervention.

- Round-Up Payments: Round up each payment to the nearest dollar or five dollars, automatically contributing extra towards the principal.

- Bi-Weekly Payments: Instead of making monthly payments, make half the payment amount every two weeks. This approach effectively creates an extra payment annually.

- Snowball Method: Prioritize paying off smaller debts first, using the freed-up cash flow to accelerate the repayment of larger debts.

The Impact of Extra Payments: A Real-World Example

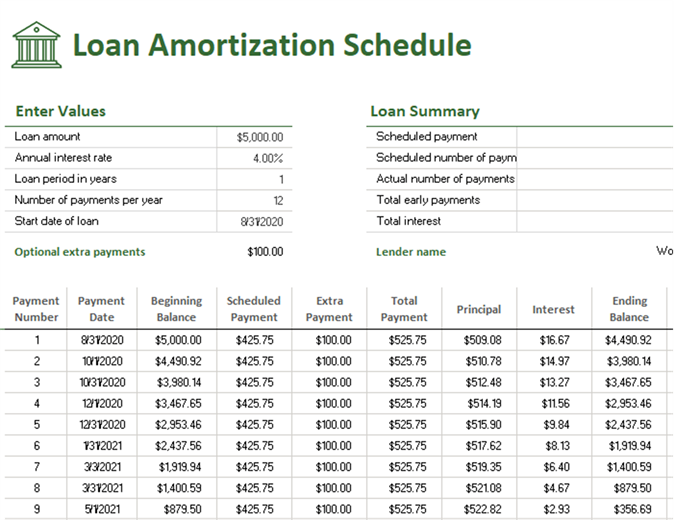

Consider a $100,000 mortgage with a 30-year term and a 4% interest rate. The traditional amortization schedule would require monthly payments of $477.42, resulting in a total interest cost of $171,071.20 over the loan’s term.

Now, let’s explore the impact of incorporating an extra $100 payment each month:

- Faster Payoff: The loan would be paid off in approximately 25 years, saving 5 years of repayment.

- Reduced Interest Costs: The total interest paid over the loan’s term would be reduced to $132,333.40, saving over $38,737.80 in interest.

This example illustrates the power of extra payments in accelerating debt repayment and minimizing interest costs.

FAQs on Amortization Calendars with Extra Payments

1. What is the best way to track extra payments on an amortization calendar?

The most effective approach is to create a separate column on the calendar to track extra payments. This column should clearly indicate the date, amount, and purpose of each extra payment.

2. How often should I make extra payments?

The frequency of extra payments is entirely dependent on your financial situation and goals. You can choose to make them monthly, quarterly, annually, or whenever you have surplus funds.

3. Can I make extra payments on any type of debt?

Yes, extra payments can be applied to various types of debt, including mortgages, student loans, car loans, and credit card debt. However, it’s important to check the loan agreement for any restrictions or penalties associated with early repayment.

4. What if I have multiple debts?

If you have multiple debts, prioritize the ones with the highest interest rates first. This strategy, known as the "avalanche method," maximizes interest savings and accelerates debt reduction.

5. Is it always beneficial to make extra payments?

While extra payments are generally beneficial, there are instances where it might not be the most advantageous strategy. For example, if you have a low-interest loan and can earn a higher return on investments, it might be more financially beneficial to invest the extra funds instead of paying down the loan.

Tips for Maximizing the Benefits of Extra Payments

- Automate Extra Payments: Set up automatic transfers from your checking account to your loan account to ensure consistent extra payments.

- Leverage Windfalls: Allocate unexpected income, such as tax refunds, bonuses, or inheritances, towards debt repayment.

- Track Your Progress: Regularly review your amortization calendar to monitor the impact of extra payments and stay motivated.

- Consider Refinancing: If interest rates have fallen since you took out your loan, consider refinancing to a lower interest rate, which can further reduce your interest costs.

Conclusion: Empowering Financial Freedom through Accelerated Debt Repayment

Amortization calendars with extra payments serve as a powerful tool for achieving financial freedom. By understanding the concept, implementing effective strategies, and leveraging the benefits of accelerated debt repayment, individuals can minimize interest costs, expedite debt elimination, and gain greater control over their finances. The journey towards financial independence is a journey of informed decision-making, and incorporating extra payments into your debt repayment strategy is a significant step in the right direction.

Closure

Thus, we hope this article has provided valuable insights into Unlocking the Power of Accelerated Debt Repayment: A Comprehensive Guide to Amortization Calendars with Extra Payments. We appreciate your attention to our article. See you in our next article!