Understanding the Significance of Pay Schedules: A Comprehensive Guide to Lowe’s 2016 Payday Calendar

Related Articles: Understanding the Significance of Pay Schedules: A Comprehensive Guide to Lowe’s 2016 Payday Calendar

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Understanding the Significance of Pay Schedules: A Comprehensive Guide to Lowe’s 2016 Payday Calendar. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Understanding the Significance of Pay Schedules: A Comprehensive Guide to Lowe’s 2016 Payday Calendar

The importance of a consistent and predictable income stream cannot be overstated. For employees, understanding when their paycheck will arrive allows for better financial planning, budgeting, and management of personal finances. This is particularly relevant for large organizations like Lowe’s, where a vast workforce relies on regular paydays to meet their financial obligations.

While specific pay schedules can vary based on individual employment agreements and company policies, a general understanding of Lowe’s 2016 pay calendar can offer valuable insights into the company’s approach to employee compensation. This information can be useful for current and potential employees, as well as individuals interested in understanding the company’s operational practices.

Historical Context: Understanding the Importance of Payday Calendars

Payday calendars are not simply lists of dates. They represent a company’s commitment to its employees’ financial well-being, reflecting a structured approach to compensation management. These calendars provide employees with crucial information regarding:

- Predictability: Knowing the exact date of their paycheck allows employees to plan their finances with greater certainty. This predictability fosters a sense of security and financial stability, reducing anxieties associated with unexpected financial burdens.

- Timely Payment: Consistent and timely payment demonstrates an employer’s commitment to its employees’ financial needs. This practice fosters a positive work environment, builds trust, and contributes to employee satisfaction.

- Transparency: Publishing a payday calendar fosters transparency, allowing employees to easily access and understand their compensation schedule. This openness contributes to a culture of trust and accountability, enhancing employee relations.

Analyzing Lowe’s 2016 Payday Calendar: A Historical Perspective

While access to specific pay dates for Lowe’s in 2016 is limited, understanding the general principles behind payday calendars allows for insights into the company’s approach to compensation.

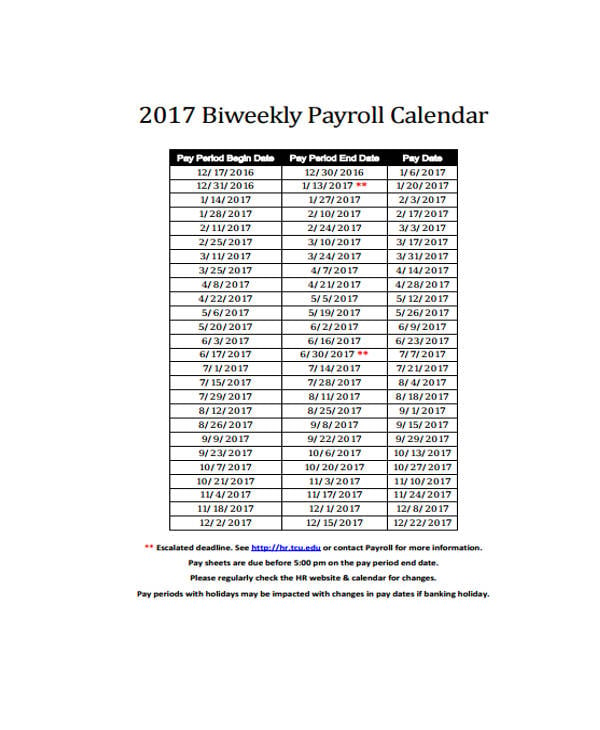

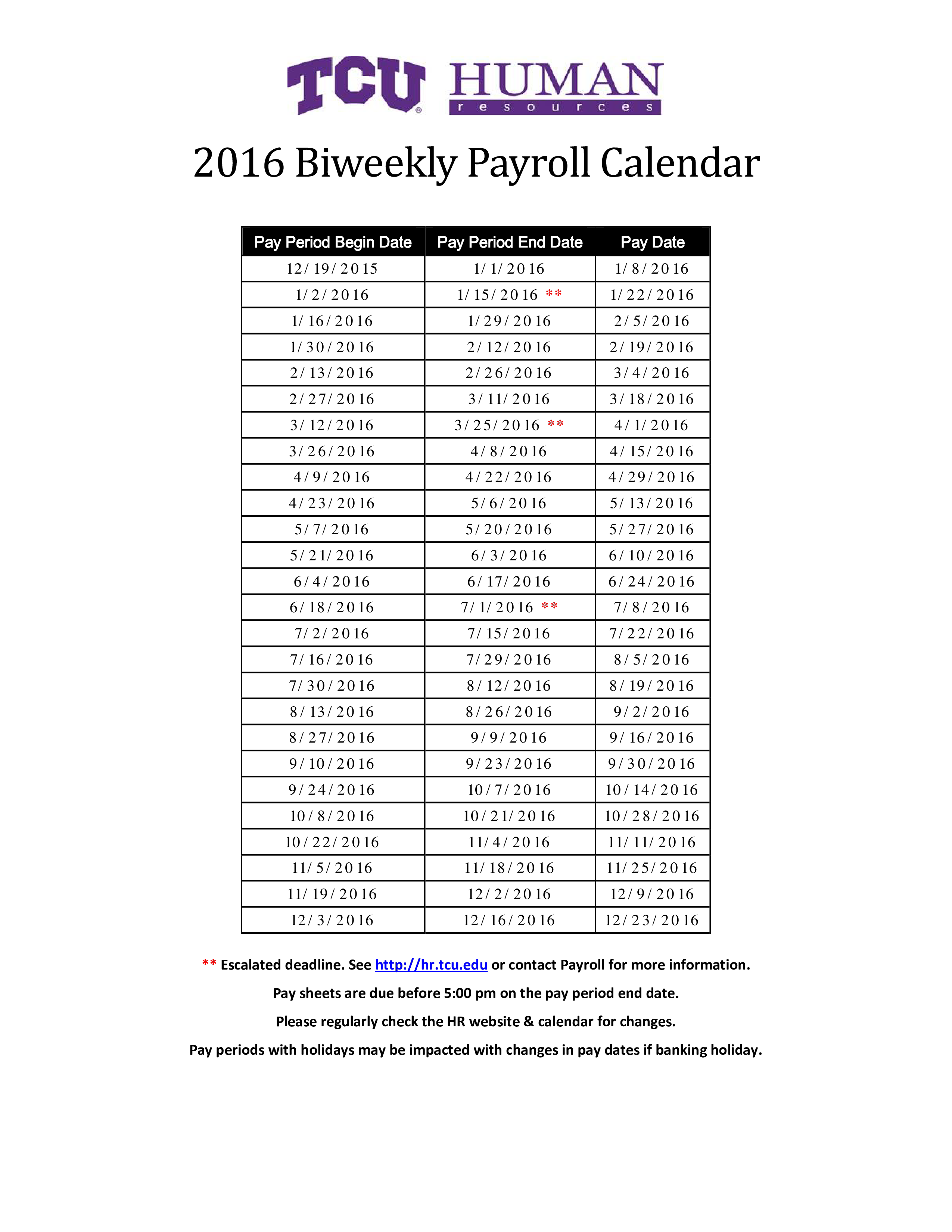

Historically, many companies, including retail giants like Lowe’s, have opted for bi-weekly or semi-monthly pay schedules. These schedules offer a balance between frequent payments and manageable administrative workload.

Bi-weekly Pay Schedules:

- Frequency: Employees receive their paycheck every two weeks.

- Benefits: This schedule provides a relatively frequent income stream, allowing for better financial planning and budgeting.

- Drawbacks: The exact date of payday can vary slightly due to the uneven number of days in each week.

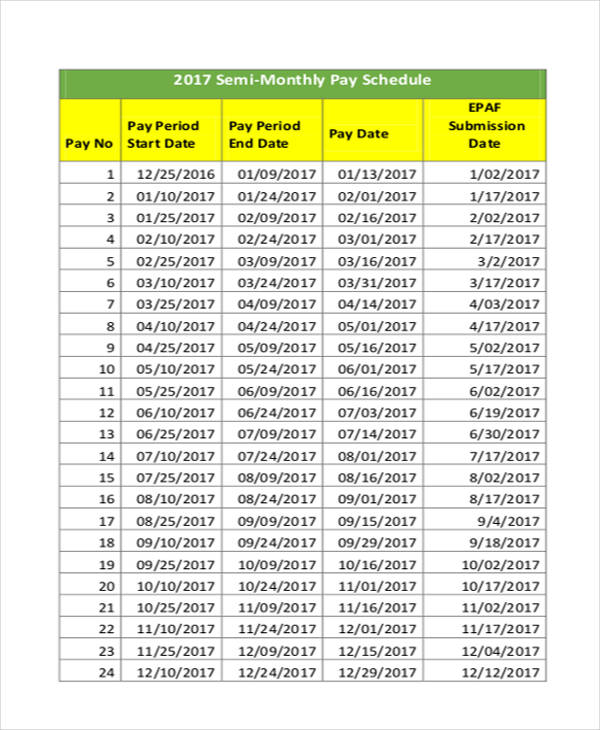

Semi-monthly Pay Schedules:

- Frequency: Employees receive their paycheck twice a month, typically on the 15th and the last day of the month.

- Benefits: This schedule offers predictable paydates, making it easier to plan for recurring expenses.

- Drawbacks: The timing of paydays may not align perfectly with individual financial needs, particularly if major expenses fall between pay periods.

Factors Influencing Pay Schedules

The specific pay schedule adopted by a company like Lowe’s is influenced by several factors, including:

- Industry Practices: Certain industries have established norms regarding pay schedules. Retail, for instance, often utilizes bi-weekly or semi-monthly pay periods to align with the cyclical nature of sales.

- Operational Efficiency: Companies consider the administrative burden associated with processing payroll. More frequent pay cycles require greater administrative resources.

- Employee Preferences: While not always the primary factor, employee preferences can also play a role in determining pay schedules.

- Legal Requirements: Specific regulations regarding minimum wage and overtime pay may influence the frequency of paychecks.

FAQs Regarding Lowe’s 2016 Payday Calendar

1. Is there a specific pay schedule for all Lowe’s employees?

While Lowe’s likely had a standard pay schedule in 2016, individual employment agreements may have specified different payment arrangements. It is important to consult individual contracts or contact HR for specific details.

2. What factors could have influenced the pay schedule in 2016?

The factors discussed earlier, including industry practices, operational efficiency, and employee preferences, would have played a role in determining Lowe’s 2016 pay schedule.

3. Are there any resources available to access historical information about Lowe’s pay schedules?

While finding a specific 2016 pay calendar may be challenging, contacting Lowe’s HR department or consulting employee handbooks from that period could provide valuable insights.

4. Can I access my historical pay stubs to understand my 2016 pay schedule?

If you were a Lowe’s employee in 2016, you may be able to access your historical pay stubs through the company’s online portal or by contacting HR.

5. Is there a way to track my current pay schedule at Lowe’s?

Current Lowe’s employees should consult their employment agreements or contact HR for information about their current pay schedule.

Tips for Managing Finances with a Variable Pay Schedule

Regardless of the specific pay schedule, effective financial management requires a proactive approach:

- Budgeting: Create a detailed budget that tracks income and expenses, factoring in both regular and variable income sources.

- Savings: Develop a savings plan that allows for emergency funds and long-term financial goals.

- Debt Management: Prioritize debt repayment and explore strategies to reduce interest charges.

- Financial Literacy: Continuously improve financial literacy by seeking resources and information on personal finance management.

Conclusion: The Importance of Payday Calendars in Employee Relations

While a specific 2016 pay calendar for Lowe’s may not be readily available, understanding the principles behind these calendars sheds light on the company’s commitment to employee financial well-being. Payday calendars provide employees with crucial information regarding their compensation, enabling them to plan for their financial needs with greater certainty and stability.

As a significant employer, Lowe’s likely maintained a consistent and transparent pay schedule, contributing to a positive work environment and employee satisfaction. By understanding the importance of payday calendars and the factors that influence them, individuals can gain valuable insights into the operational practices of companies like Lowe’s and make informed decisions regarding their employment and financial planning.

.png)

Closure

Thus, we hope this article has provided valuable insights into Understanding the Significance of Pay Schedules: A Comprehensive Guide to Lowe’s 2016 Payday Calendar. We appreciate your attention to our article. See you in our next article!