Navigating the California Pay Period Calendar: A Comprehensive Guide for Employees and Employers

Related Articles: Navigating the California Pay Period Calendar: A Comprehensive Guide for Employees and Employers

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the California Pay Period Calendar: A Comprehensive Guide for Employees and Employers. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the California Pay Period Calendar: A Comprehensive Guide for Employees and Employers

The California Pay Period Calendar, a crucial aspect of labor law in the state, dictates the frequency and timing of employee compensation. Understanding its intricacies is essential for both employees and employers to ensure compliance with state regulations and maintain a smooth payroll process. This guide will delve into the nuances of the California Pay Period Calendar, providing a comprehensive overview of its key features, legal implications, and practical implications for both sides of the employment relationship.

Understanding the Basics: Pay Periods in California

California law mandates that all employees, regardless of their employment status (full-time, part-time, or temporary), must be paid at least once every pay period. The law defines a pay period as a fixed period of time during which an employee’s wages are calculated and paid. The most common pay periods in California are:

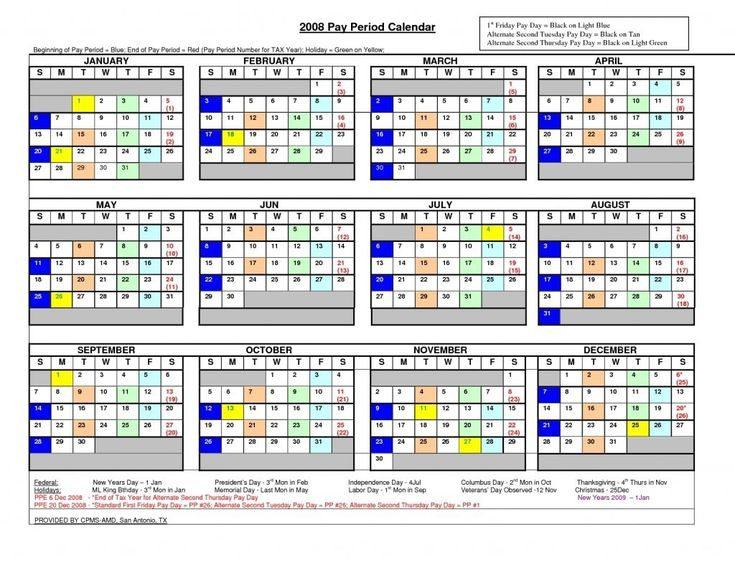

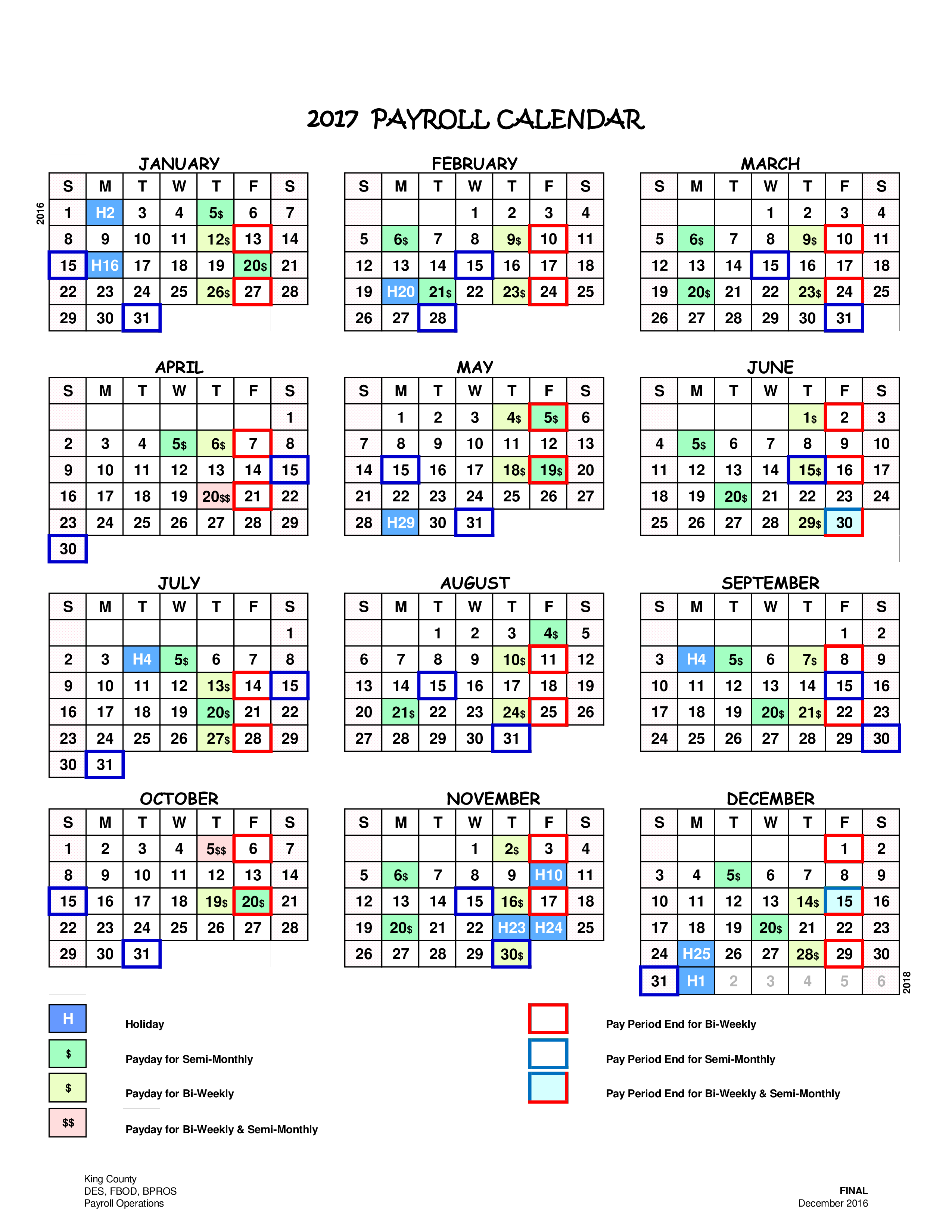

- Biweekly: Paid every two weeks, typically on a Friday or a Monday.

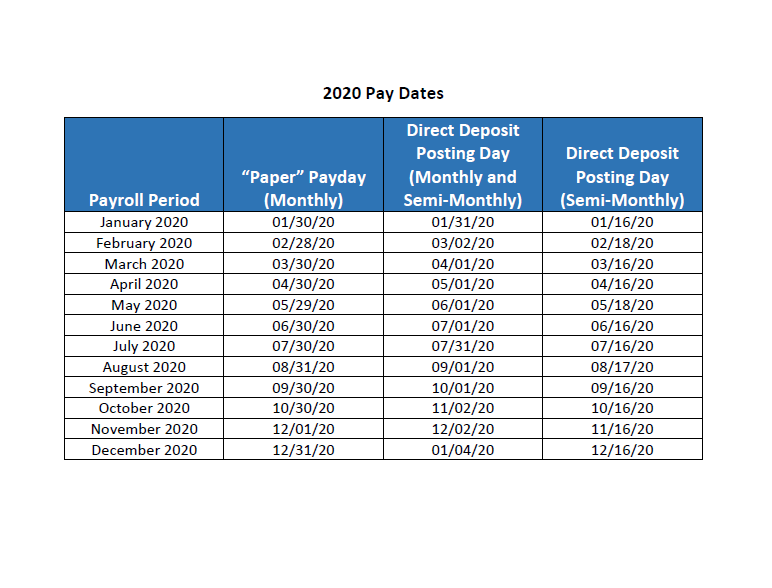

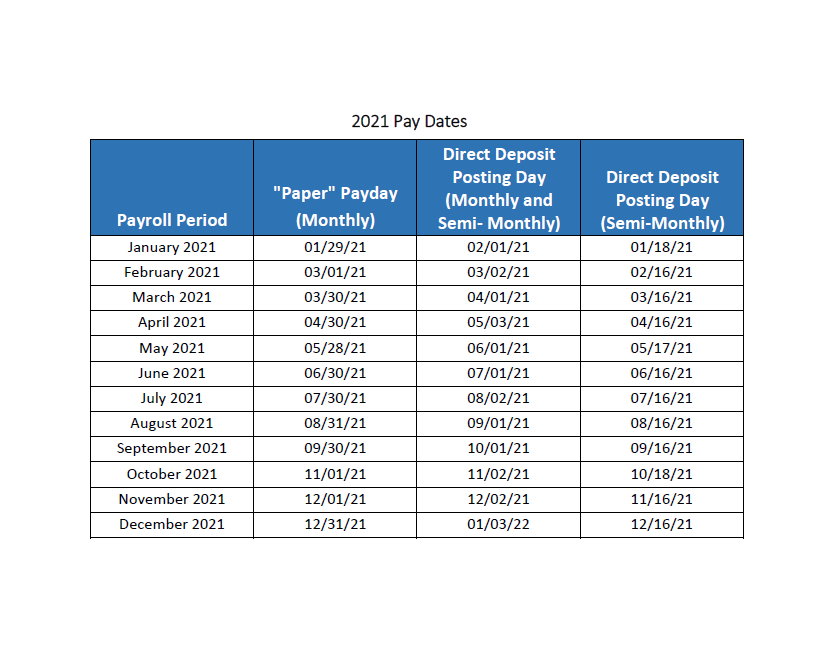

- Semimonthly: Paid twice a month, typically on the 15th and the last day of the month.

- Monthly: Paid once a month, typically on the last day of the month.

The California Labor Code and its Impact on Pay Periods

The California Labor Code (CLC) is the primary legal framework governing employment practices in the state. Specifically, Section 204 of the CLC addresses the frequency of wage payments, stating that:

"Every employer shall pay wages to his or her employees not less frequently than once every two weeks, or twice a month, or once a month, as determined by the employer."

This section provides employers with flexibility in choosing their preferred pay period frequency, but it also establishes a minimum standard of biweekly payment.

Beyond Frequency: Key Aspects of the California Pay Period Calendar

While the frequency of payment is essential, the California Pay Period Calendar encompasses more than just the number of paychecks an employee receives. It also dictates the following:

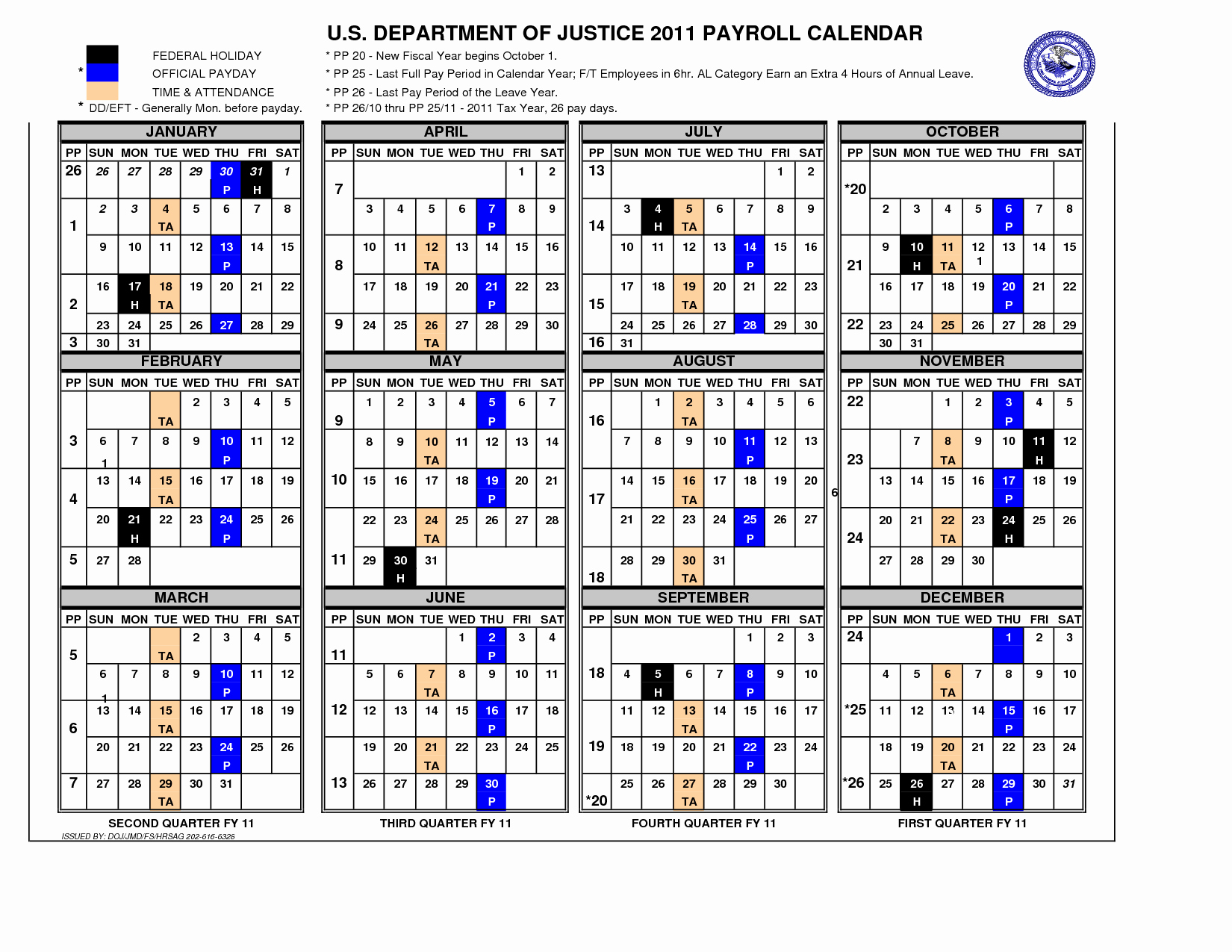

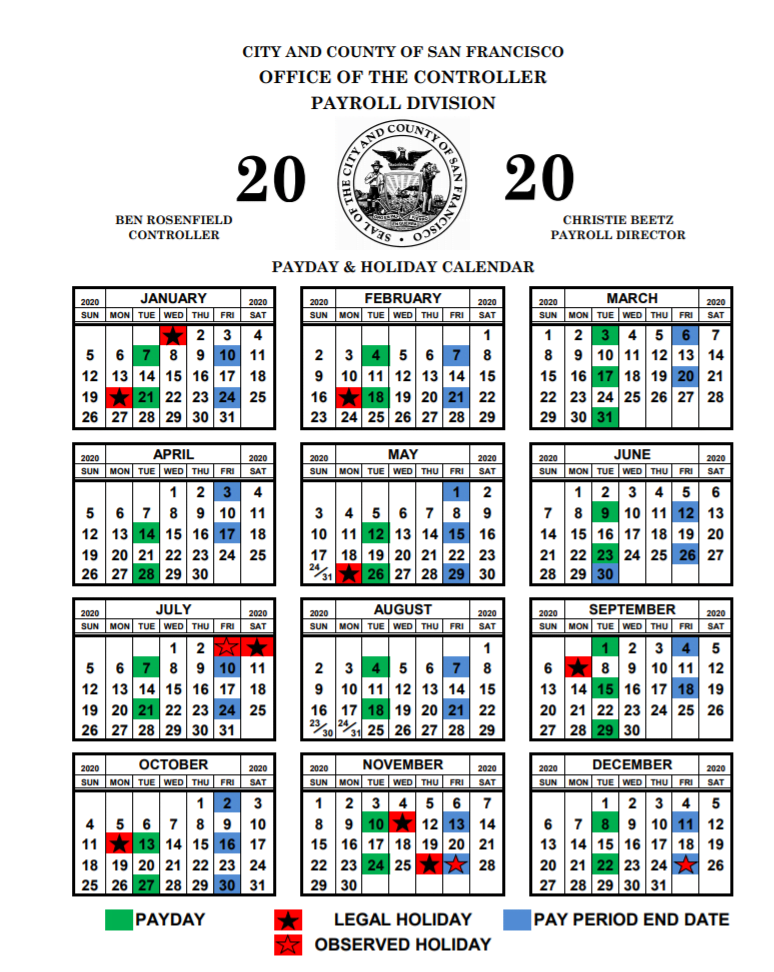

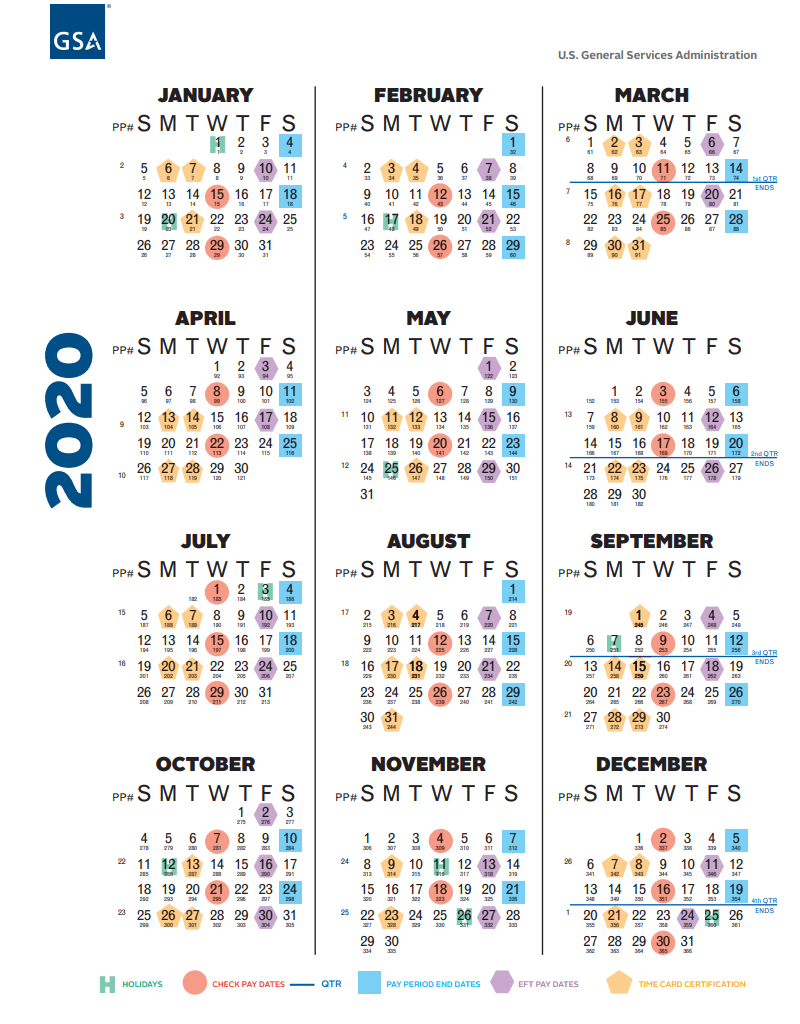

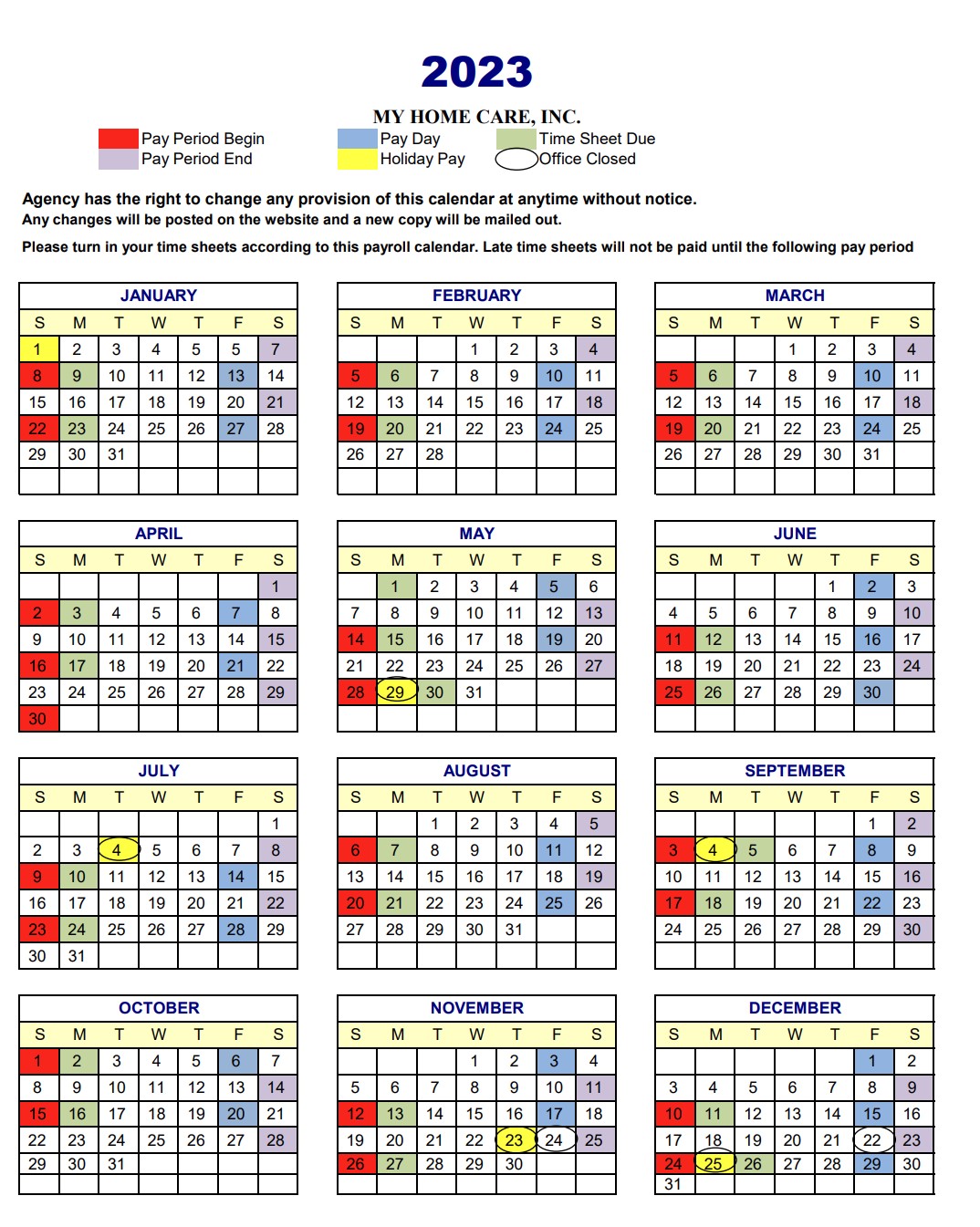

- Payday: The specific date on which employees are paid. This date must be clearly communicated to employees and consistently adhered to.

- Pay Period End Date: The final day of the pay period, marking the cut-off point for calculating wages earned. This date is crucial for tracking hours worked and determining overtime eligibility.

- Overtime Calculation: The California Pay Period Calendar is directly relevant to overtime calculations. Overtime is typically calculated based on the number of hours worked in excess of 40 hours within a single workweek. The definition of a workweek can vary depending on the employer’s chosen pay period, so understanding this relationship is critical.

Benefits and Implications of a Defined Pay Period Calendar

The California Pay Period Calendar, while seemingly straightforward, plays a vital role in ensuring fair labor practices and promoting a stable working environment. Its benefits extend to both employers and employees:

For Employees:

- Predictable Income: A consistent pay schedule provides employees with a predictable income stream, aiding in financial planning and budgeting.

- Transparency and Accountability: A clearly defined pay period calendar ensures transparency in wage calculations and provides employees with a basis for tracking their earnings and overtime hours.

- Legal Protection: The California Pay Period Calendar serves as a legal framework, protecting employees from delayed or unpaid wages.

For Employers:

- Streamlined Payroll Process: A defined pay period calendar simplifies the payroll process, allowing for efficient wage calculations and timely payments.

- Improved Employee Relations: Consistent paychecks and transparency in compensation contribute to a positive and productive work environment, fostering trust and employee satisfaction.

- Legal Compliance: Adhering to the California Pay Period Calendar ensures compliance with state labor laws, mitigating the risk of penalties and legal disputes.

Navigating the Calendar: Practical Considerations

Understanding the California Pay Period Calendar is not just a legal requirement; it’s a practical necessity for both employers and employees. Here are some key considerations for each group:

For Employees:

- Review Pay Stubs: Regularly review your pay stubs to ensure accurate calculation of wages, overtime, and deductions.

- Track Hours Worked: Keep detailed records of your work hours to ensure accurate payment for overtime and ensure compliance with the designated workweek.

- Communicate with Employer: If you have any questions about your pay period, payday, or overtime calculations, don’t hesitate to communicate with your employer.

- Know Your Rights: Familiarize yourself with your rights under California labor law, particularly regarding wage payment, overtime, and deductions.

For Employers:

- Establish Clear Pay Period Policy: Communicate your chosen pay period, payday, and workweek definition clearly to all employees.

- Implement Consistent Payroll Practices: Ensure that payroll processes are consistent and accurate, adhering to the established pay period calendar.

- Provide Timely and Accurate Paychecks: Pay employees on time and ensure that their pay stubs reflect accurate wage calculations and deductions.

- Stay Informed of Labor Law Updates: Keep abreast of any changes or updates to California labor law that may affect your pay period practices.

FAQs: Addressing Common Questions about the California Pay Period Calendar

1. Can an employer change the pay period?

Yes, an employer can change the pay period, but they must provide employees with written notice of the change at least 72 hours before the change takes effect.

2. What happens if an employer fails to pay on time?

If an employer fails to pay employees on time, they may be subject to penalties under California labor law. These penalties can include fines, interest, and even legal action.

3. How is overtime calculated in California?

Overtime is typically calculated as time and a half for hours worked in excess of 40 hours within a single workweek. The definition of a workweek can vary depending on the employer’s chosen pay period.

4. What if an employee works on a holiday?

California law requires employers to pay employees double their regular rate of pay for work performed on certain holidays. The specific holidays covered are outlined in the California Labor Code.

5. What are the consequences of not paying overtime?

Failing to pay overtime can result in penalties for the employer, including fines, interest, and potential legal action. Employees may also have the right to file a wage claim to recover unpaid overtime wages.

Tips for Effective Pay Period Management

- Utilize Payroll Software: Implementing payroll software can streamline payroll processes, improve accuracy, and minimize the risk of errors.

- Develop a Clear Pay Period Policy: A written policy outlining the pay period, payday, workweek definition, and overtime calculation methods is essential.

- Communicate Regularly with Employees: Keep employees informed about any changes to the pay period or payroll practices.

- Seek Legal Advice: If you have any questions or concerns about the California Pay Period Calendar, consult with an employment attorney.

Conclusion: The Importance of a Well-Defined Pay Period Calendar

The California Pay Period Calendar is not merely a regulatory requirement; it is a cornerstone of fair labor practices and a vital component of a healthy employer-employee relationship. By understanding its nuances and adhering to its guidelines, employers can ensure legal compliance, promote employee satisfaction, and foster a stable work environment. Employees, in turn, can benefit from predictable income, transparency in compensation, and legal protection against wage violations. Navigating this calendar effectively requires a collaborative effort from both sides, ensuring that the rights and responsibilities of both employers and employees are respected and upheld.

Closure

Thus, we hope this article has provided valuable insights into Navigating the California Pay Period Calendar: A Comprehensive Guide for Employees and Employers. We thank you for taking the time to read this article. See you in our next article!